Maintenance and major repairs continue to pressure English Social and Affordable Housing Providers’ finances. Morningstar DBRS reports on the publication of the Regulator of Social Housing’s 2025 global accounts.

On 16th January, the Regulator of Social Housing published the 2025 global accounts of the sector, for the accounts ending March 2025. English Social and Affordable Housing Providers (SAHPs) slightly improved their financial performance in 2025, supported by the largest permitted rent increase in two decades. However, EBITDA margins remain under pressure as repair and maintenance costs rose sharply, driven by higher stock quality requirements and new regulatory standards.

Despite sustained investment in new supply and reasonably stable liquidity levels, the sector’s rising interest burden, declining cash reserves, and elevated capital needs continue to constrain finances. Looking forward, significant ongoing investment — alongside government rent policy stability and new funding programmes — will shape providers’ capacity to meet quality, safety and development objectives, though development forecasts have been revised downward in response to persistent operating and macroeconomic challenges.

Higher permitted rental increase not enough to compensate for the maintenance and repair cost

English SAHPs reported higher turnover and slightly increasing EBITDA in the 2025 financial year, primarily supported by increased rental income following the highest permitted rent uplift in two decades which reached 7.7%, based on the September 2023 CPI + 1%. Growth in the number of housing units rent also contributed to the sector’s improving performance in 2025. However, EBITDA margins remain subdued, lingering at levels last seen in the aftermath of the global financial crisis.

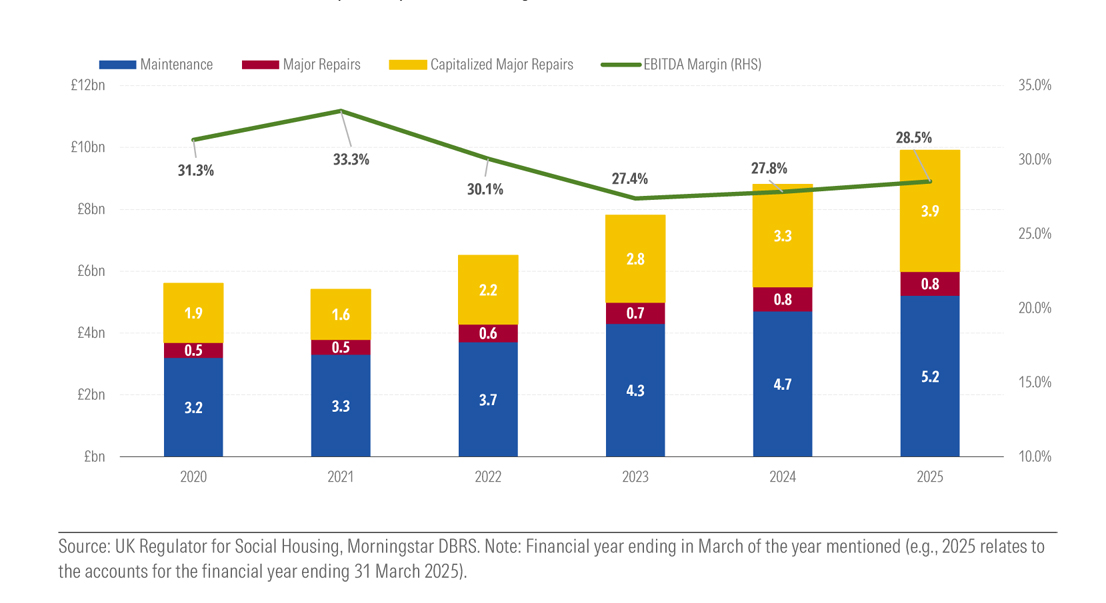

This continued margin pressure is largely attributable to a significant escalation in repair and maintenance expenditure, which has risen by 42% in real terms compared with pre-pandemic levels and by 13% year over year (Exhibit 1). SAHPs have cited higher volumes of responsive repairs, driven by increased stock surveying activity, ongoing management requirements, and an enhanced focus on stock quality. Additionally, compliance with the 2024 consumer standard — which mandates higher expectations for maintenance, safety, stock quality, and timely repairs — has increased spending on fire remediation, building safety and energy efficiency measures.

The sharp increase in repair and maintenance costs culminated in sector-wide spending of £10bn in 2025, maintaining pressure on EBITDA margins and interest coverage ratios. Despite these challenges, the sector continues to allocate substantial capital to new housing supply, with £11.4bn invested in 2025 — above pre-pandemic levels and only slightly below 2024. During the year, 54,000 new homes valued at £10.2bn were completed. As a result, the total value of housing assets increased by £10.4bn to GBP £218.2bn as of March 2025, reflecting both reinvestment in existing stock and new development activity.

Debt Stock Continues to Rise, Recourse to Alternative Sources of Funding Decline

Debt Stock Continues to Rise, Recourse to Alternative Sources of Funding Decline

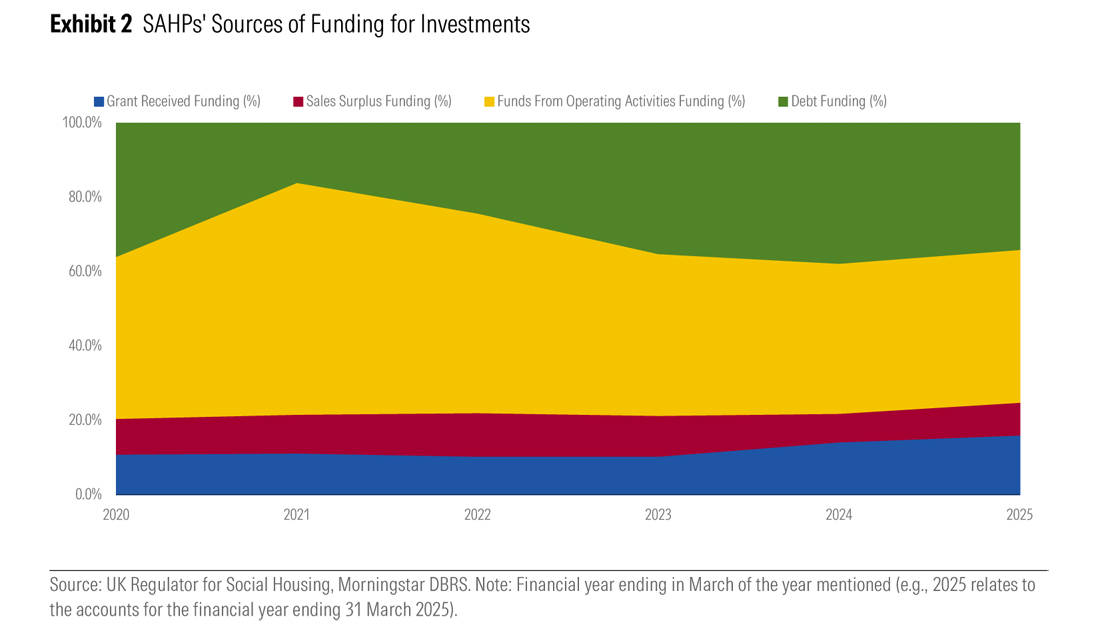

Over the past five years, the value of total investments has increased by £79.8bn, with approximately 30% of those capital expenditures funded through additional borrowing. The remaining investment was supported by internally generated cash flows reinvested into existing and new stock, as well as new grant funding, which accounted for 13% of total investment during the period (Exhibit 2). Debt stock continued to increase in 2025, reaching £104.2bn versus £98.6bn in 2024. However, net debt to EBITDA slightly improved in 2025, at 12.9 times (x) versus 13.6x in 2024.

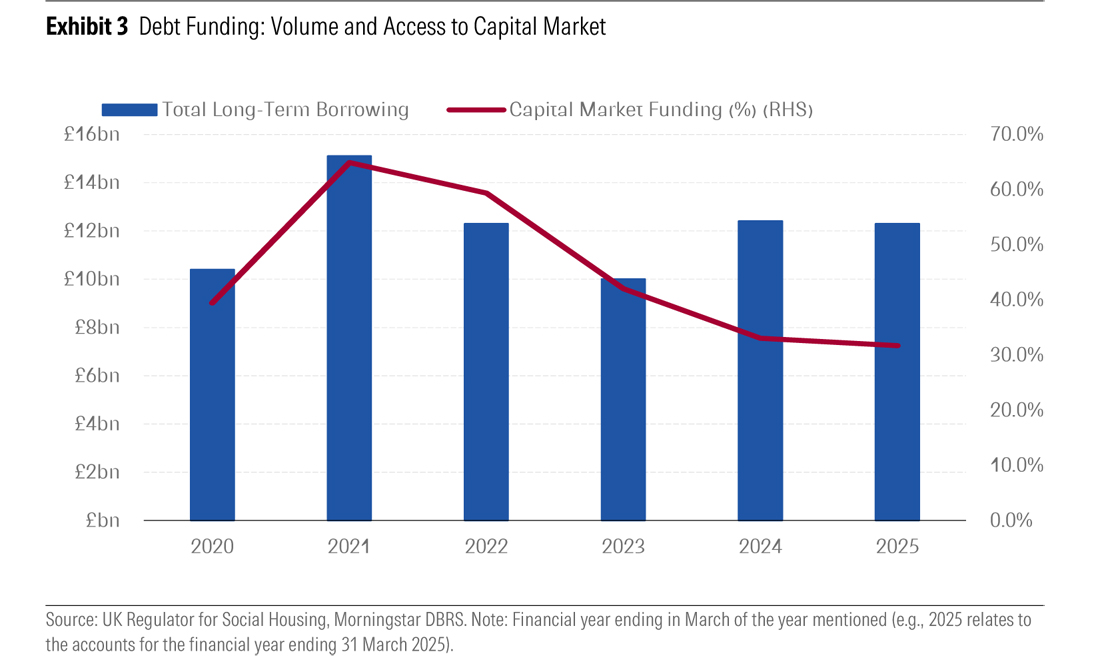

Both new long-term funding volumes and the share of funding from capital markets fluctuated over the last six years. Recourse to the capital markets accounted for 32% of the funding for the 2025 financial years, which remains below the average of 54% during 2020—22.

Reduction in new development expected to compensate for pressures on repairs and maintenance

Reduction in new development expected to compensate for pressures on repairs and maintenance

Looking ahead, we expect SAHPs to further increase their spending on repairs and maintenance, with average annual investment projected at approximately £10.9bn over the next five years versus £8.2bn in the last five years. However, investment strategies will need to be reassessed to reflect future grant allocations, the implementation of Awaab’s Law on safety, Decent Homes Standard, and the Minimum Energy Efficiency Standard. To support these investment requirements, the Government has confirmed that social housing rents will continue to follow the CPI + 1% formula for a further 10 years. In addition, the recent Spending Review announced a £39bn, 10-year Social and Affordable Homes Programme (SAHP 2026–36), aimed at accelerating the delivery of social and affordable housing nationwide. The government also outlined the availability of £2.5bn in low-interest loans to supplement commercial borrowing and facilitate development activity.

Nevertheless, the substantial investment required in the existing stock is expected to keep financial headroom constrained across the sector. Reflecting these pressures, aggregate development forecasts have been revised downward in January 2026: SAHPs now anticipate delivering around 274,000 new homes by 2030, compared with the 333,000 projected in 2023. This adjustment reflects the sector’s response to the evolving operating environment and broader macroeconomic conditions.

Header image: Chart shows maintenance and repair expenses for English SAHPs continue to rise